. . . . . . .

Over the course of my trading ‘journey’ I have had the good fortune of attending 3 Fibonacci Trader workshops presented by the late Robert Krausz. On one occasion during the 3rd workshop I was speaking to Mr. Krausz about Gann when he remarked to me . . . “my frustration with Gann is that he never once paid any homage to Fibonacci”.

From my study of Gann I could agree with Mr. Krausz but only years later could I fully appreciate the depth of Mr. Krausz’s frustration. For you see, you can’t speak of ‘Time’ without Phi. You can’t speak of ‘Natural Law’ without Phi.

So when you speak about the ‘Law of Vibration’ as coined by W.D. Gann . . . it is explicitly Phi.

From W.D. Gann’s Ticker interview:

“Science has laid down the principle that the properties of periodic function are most intimately associated with numerical relationship. The numbers are not intermixed accidentally but are subject to regular periodicity.

Thus, I affirm every class of phenomena, whether in nature or in the stock market, must be subject to the universal law of causation and harmony. Every effect must have an adequate cause.

If we wish to avert failure in speculation we must deal with causes. Everything in existence is based on exact proportion and perfect relationship. There is no chance in nature, because mathematical principles of the highest order lie at the foundation of all things. Faraday said, ‘There is nothing in the universe but mathematical points of force’.”

‘Momentum Wave’ Math to Ponder:

This entire ‘Info’ site is about understanding the nature of vibration, which is understanding the relationship of the opposing forces (Above and Below) which play out in an interwoven cyclic Phi sequence of Time.

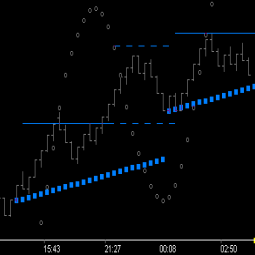

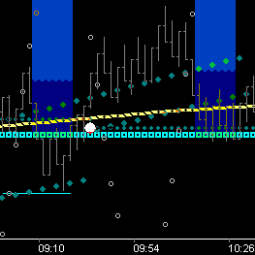

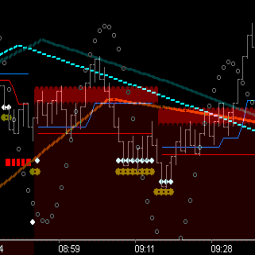

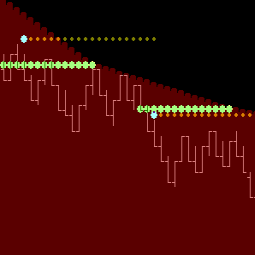

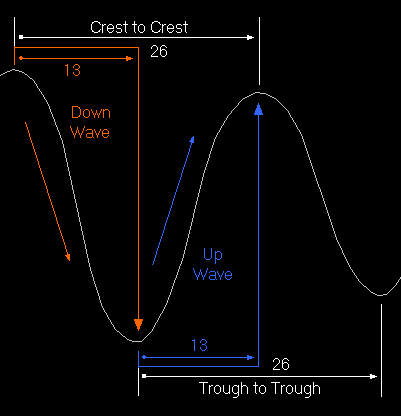

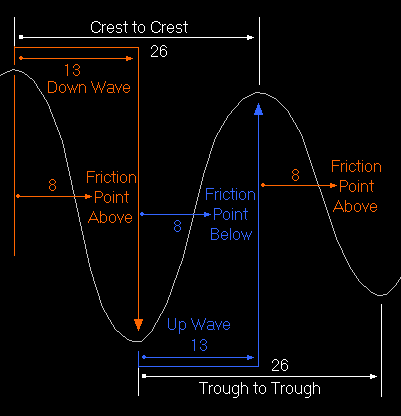

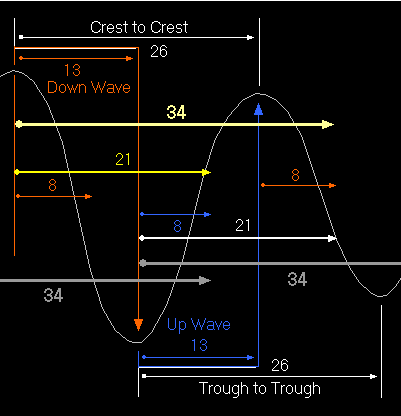

All markets vibrate with a wave cycle length of 26. That means that wave crest to trough (the down wave) has a duration of 13 and wave trough to crest (the up wave) has a duration of 13.

Causation: The self-perpetuating cause of the wave itself is friction. Friction is generated when price penetrates the wave leg, up or down.

Causation: The self-perpetuating cause of the wave itself is friction. Friction is generated when price penetrates the wave leg, up or down.

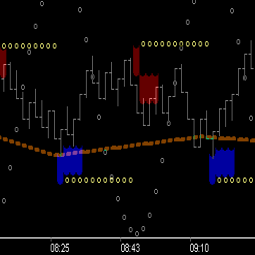

Penetration of the down wave (the above friction point) tends to occur at the 8 count from the crest. Penetration of the up wave (the below friction point) tends to occur at the 8 count from the trough.

Note: From the picture above, looking back from Crest or Trough reveals that from point of friction to wave turn tends to be a 5 count. [13-8]

Note: From the picture above, looking back from Crest or Trough reveals that from point of friction to wave turn tends to be a 5 count. [13-8]

Time from crest to ‘friction point below’ = 21. Time from trough to ‘friction point above’ = 21. [13+8]

Time from crest to ‘crest friction point’ = 34. Time from trough to ‘trough friction point’ = 34. [21+13] or [26 +8]

Above math reveals that 8 count from trough is same as 21 count from crest. A synchronous time moment between opposing forces.

Above math reveals that 8 count from trough is same as 21 count from crest. A synchronous time moment between opposing forces.

Which means?

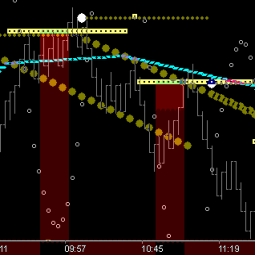

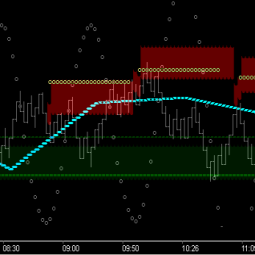

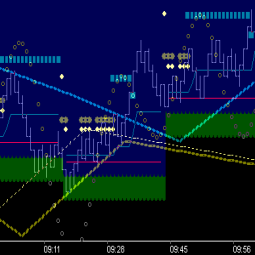

Every friction point (the Sacred Cut) is a significant point in time for trading because price is specifically ‘Looking Back From’ this ’21 count point in Time’ at the friction vectors set in motion from prior Wave Crest and Trough. Generally speaking it is decision time for either continuance, or change. This is especially true when price has moved to the exact Threshold of the change, as shown below.

. . . and the 34 count from wave hi/lo is the ‘Octave friction point’.

. . . and the 34 count from wave hi/lo is the ‘Octave friction point’.

Which should be . . . well . . . It Is!

Controlling Directional Bias!

The 34 time fence (Tm34) is (relatively speaking) the strongest and therefore is the general direction to trade. Do not trade against it without specific trade entry types.

W.D. Gann wrote a book in 1927 entitled ‘Tunnel Thru the Air’, with an alternate title ‘Looking Back from 1940’.

(1940 – 1927) = 13

(27 – 19) = 8

(40 – 19) = 21

.666 * 40 = 26.64 [the wave of vibration]

1.666 * 27 = 45 [the diagonal of the square (ie. cycle)]

I find that interesting.

Perhaps W.D. Gann did pay homage to Fibonacci . . . in his own way. [ . . . Next]