The geometric constructs of vibration present numerous ‘strange attractors’ that price reacts to. Consequently, it is not uncommon to end up with ‘too may lines’ on the price chart. This can be frustrating when trading because clarity of direction is often hidden or missing.

After 17+ years of researching vibration and its multitude of principles I can tell you without any doubt, the Phi-based ‘Time Fence’ principle, generated from the Momentum Wave Friction Vectors, is unequaled in accurately communicating the current Directional Bias (dBias) of price action.

The goal then is to use Time Fence filtering to improve the results of any trading method. Primarily I trade gNomonic targeting, which is the next discussion topic, but any trading method will find meaningful statistical improvement from dBias filtering.

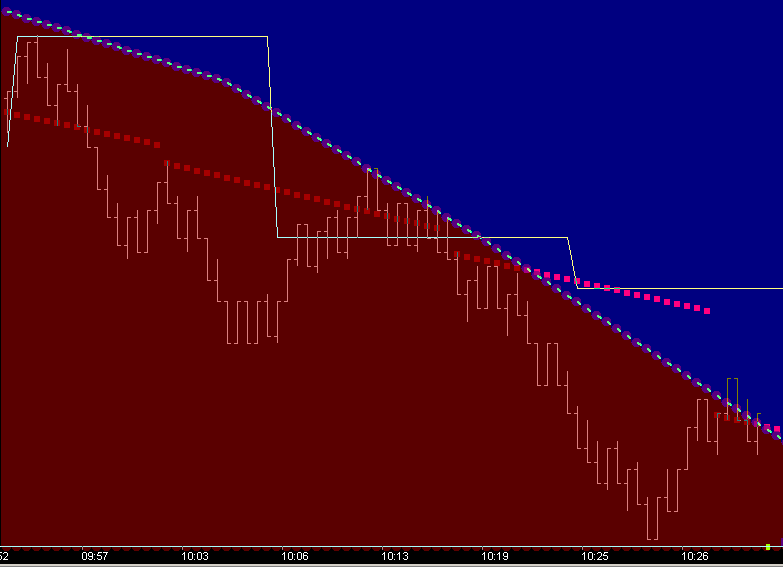

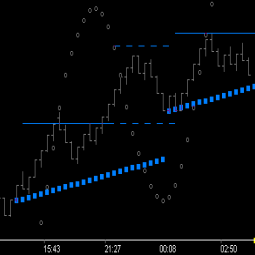

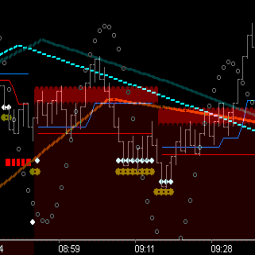

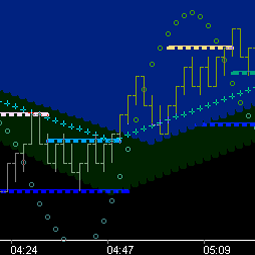

As discussed previously, the trough Tm17 fence is my favorite fence for day to day filtering. Shown above dBias is negative because price is below the Tm17 fence (cyan) and consequently (because of filtering) only the crest fVectors show. With dBias [-], any movement above fVector is a retracement to the fence. Clarity of direction with minimal information.

It could also look like this.

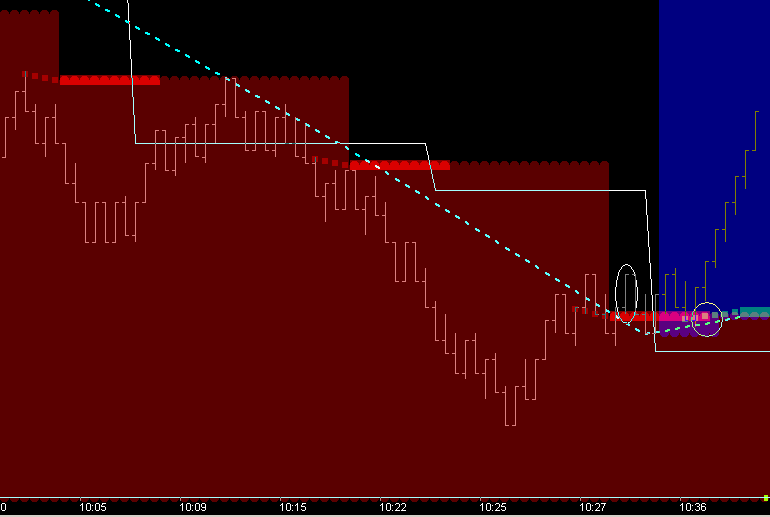

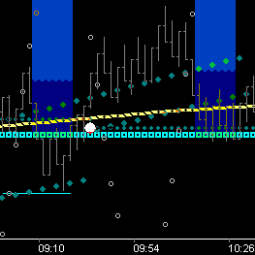

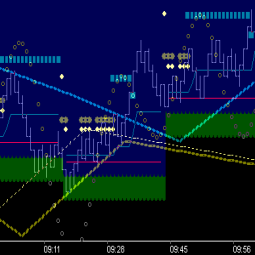

Remember price below crest friction (Sacred Cut) is negative. The horizontal line pictured above is the .5 friction level of the damping wave. A great filter all by itself. Complete clarity combined with a good time fence as shown. Notice that last bar shown at the end of the chart has closed above the fence. Which means the next bar (not shown) will be opening above the fence. By definition then, that bar will have ‘Free Radical’ potential (ie reversal potential). All it has to do is go straight up without having the lo of the bar touch the time fence. If that occurs, you are no longer entertaining shorts. The dBias (momentum) will switch to ‘Long’ with upside potential.

Does it have to follow through like this? Of course not, . . . but combined with tunneling the Sacred Cut like this, you have minimum risk/max reward.

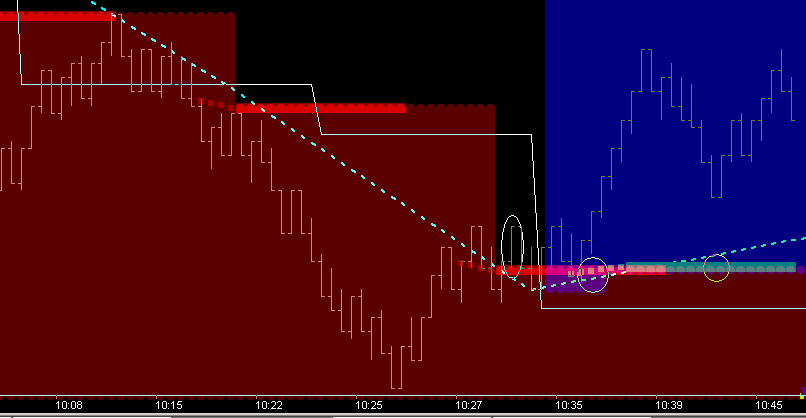

Does it have to follow through like this? Of course not, . . . but combined with tunneling the Sacred Cut like this, you have minimum risk/max reward.

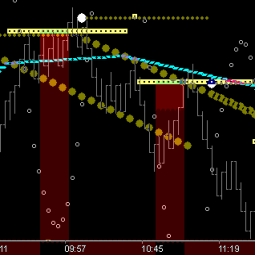

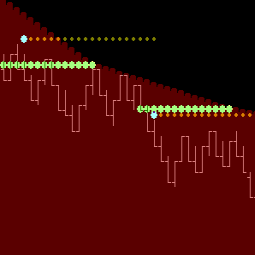

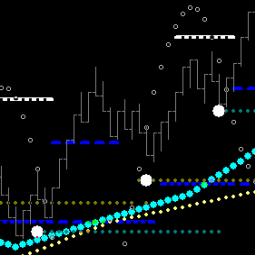

Now I generally don’t set the zone coloring to specifically follow the fence like in the examples above. I prefer a ‘square’ feel to the chart as shown below.

Above I’m running the dBias filtering (red color) horizontal out from the Tm3 level of the crest friction vector. This is repetitively a very good level on any size fractal. And you can see this ‘square’ perspective adds new ‘clarifying’ information when price moved above Sacred Cut at ~10:12. I’ve also added a 2nd colored horizontal that runs out 10 bars from Tm3 (ie runs to Tm13, wave midpoint). Price will generally go out of its way to use that 13 count as an action point. Most often a retracement into this time is common. Notice this crest Tm13 action point at ~10:36 and think of everything you know at that point in time. If the momentum change to the upside, which just setup, is going to take hold, it is now, Tm13. Price has been consolidating for 8 bars since free radical reversal and this is perfect decision time. Opportunity for max reward with minimum risk. Successful trading starts when you recognize this for the ‘Threshold’ that it is. AND . . . this kind of threshold event occurs over and over again with vibration. You just have to be able to see it.

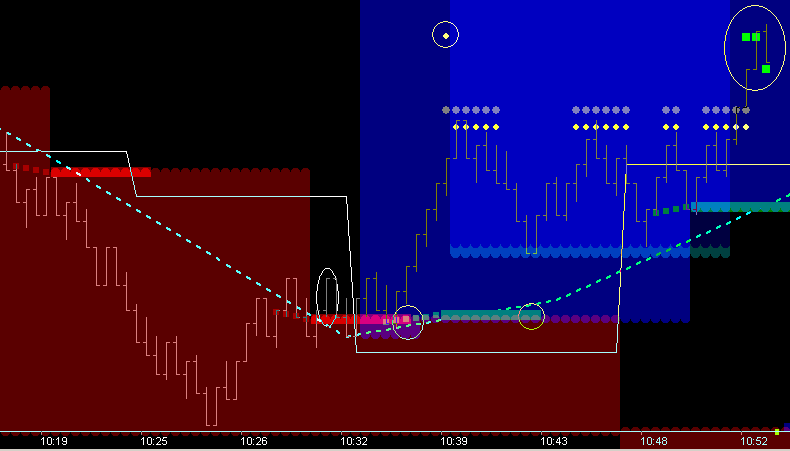

In addition . . . do not forget the 21 count. Pictured below I have changed the Tm13 marker to run out to Tm21. Review the ‘Square of 9‘ again and note that 21 lies on the the 45 angle in the 2nd wrap. Contemplate it’s relationship position in the spiral:

- 360* higher is an octave

- 360* higher is also the 4th gNomonic expansion level of any cycle (ie 360* of Price expansion)

- 90* higher is the 3rd gNomonic expansion level of any cycle (ie 270* of Price expansion)

- 90* lower is the 2nd gNomonic expansion level of any cycle (ie 180* of Price expansion)

- 90* lower is price_time 17 of any cycle and regeneration time of the ‘Sqr9’ (ie, 108*_Vesica Piscis)

- 180* lower is 13 . . . which also lies on the 45 angle (ie a significant ‘Corner’ [threshold timer])

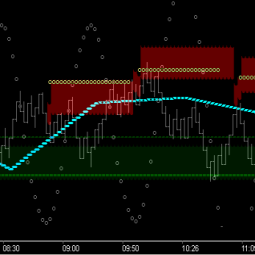

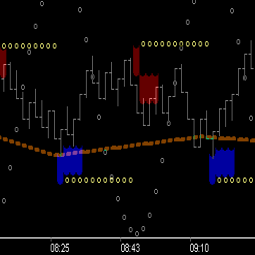

Notice above: crest Tm21 was pivot hi and pivot lo during the [-] dBias, and pivot hi during [+] dBias. Trough Tm13 (~10:41) was pivot lo, but no entry (or re-entry) without further information . . .

Like a good gNomonic targeting mechanism as shown above. Pictured is the ‘Real-Time Planetary Bias’ cycle of Moon .256. [. . . Next]